Simplifying payment processing for your business

At Pay By Card, we empower ambitious businesses with a reliable launchpad for growth through secure online payment solutions, while enhancing consumer transactions with seamless experiences.

Simplifying payment processing for your business

At Pay By Card, we empower ambitious businesses with a reliable launchpad for growth through secure online payment solutions, while enhancing consumer transactions with seamless experiences.

Partnerships with Banks

Merchants

Reduction in Chargebacks

Uptime for Payment Processing

Our Benefits

Secure Transactions

Your transactions are protected with advanced security measures provided by Pay By Card and its partners, ensuring safety from fraud and unauthorized access.

Fast Processing

Process payments quickly and efficiently with Pay By Card's seamless payment systems, reducing downtime and improving transaction speed.

High-Risk Industry Approvals

Even businesses in high-risk industries can get fast approvals with Pay By Card, making it easier to get the payment processing you need.

Competitive Rates

Benefit from Pay By Card’s competitive rates, providing cost-effective payment processing solutions that help you save money.

24/7 Support

Access support any time, day or night, with Pay By Card’s around-the-clock customer service, ensuring you get the help you need whenever you need it.

Multi-Currency Support

Expand your business globally with Pay By Card’s multi-currency support, allowing you to accept payments from customers around the world.

Seamless Integration

Integrate Pay By Card’s payment processing seamlessly with your existing systems, minimizing disruptions and ensuring a smooth transition.

Fraud Prevention

Reduce the risk of fraud with Pay By Card’s advanced fraud prevention tools, ensuring your business and customers are protected.

- Online Processing

- In Store Processing

- Dispute Tools

|

Online & E-Commerce PaymentsEfficiently handle various payment methods on your ecommerce platform. |

Online & E-Commerce paymentsEfficiently handle various payment methods on your ecommerce platform. |

|

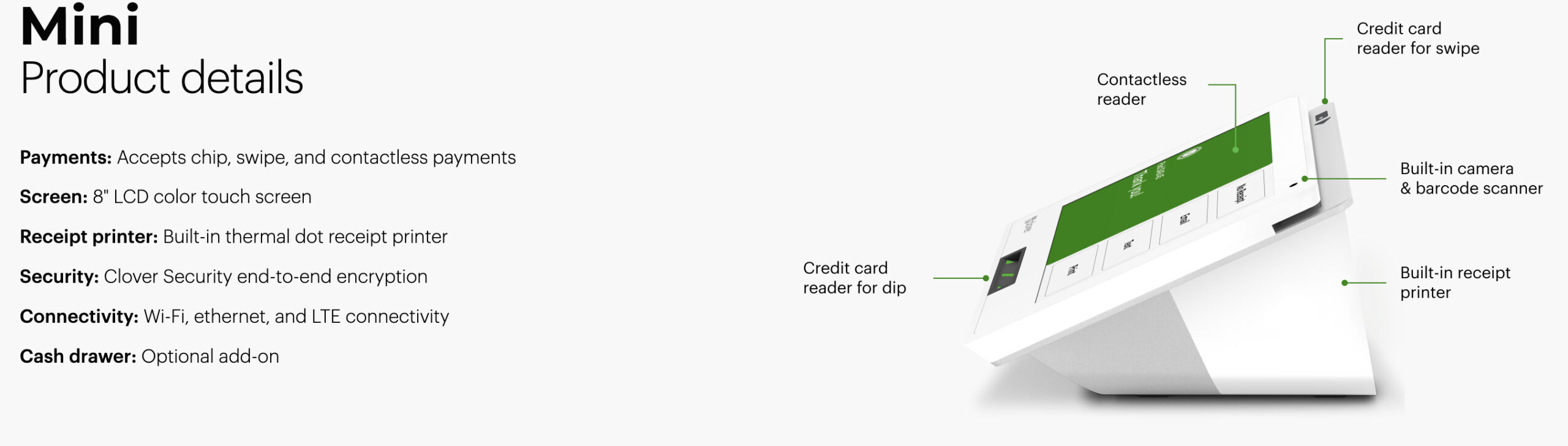

In Store PaymentsStreamline in-store transactions with Pay By Card’s tailored solutions for retail environments. Our POS systems are designed for ease of use and integration with your existing setup. Accept all major credit and debit cards seamlessly, and enjoy quick and reliable transaction processing. |

In Store PaymentsStreamline in-store transactions with Pay By Card’s tailored solutions for retail environments. Our POS systems are designed for ease of use and integration with your existing setup. Accept all major credit and debit cards seamlessly, and enjoy quick and reliable transaction processing. |

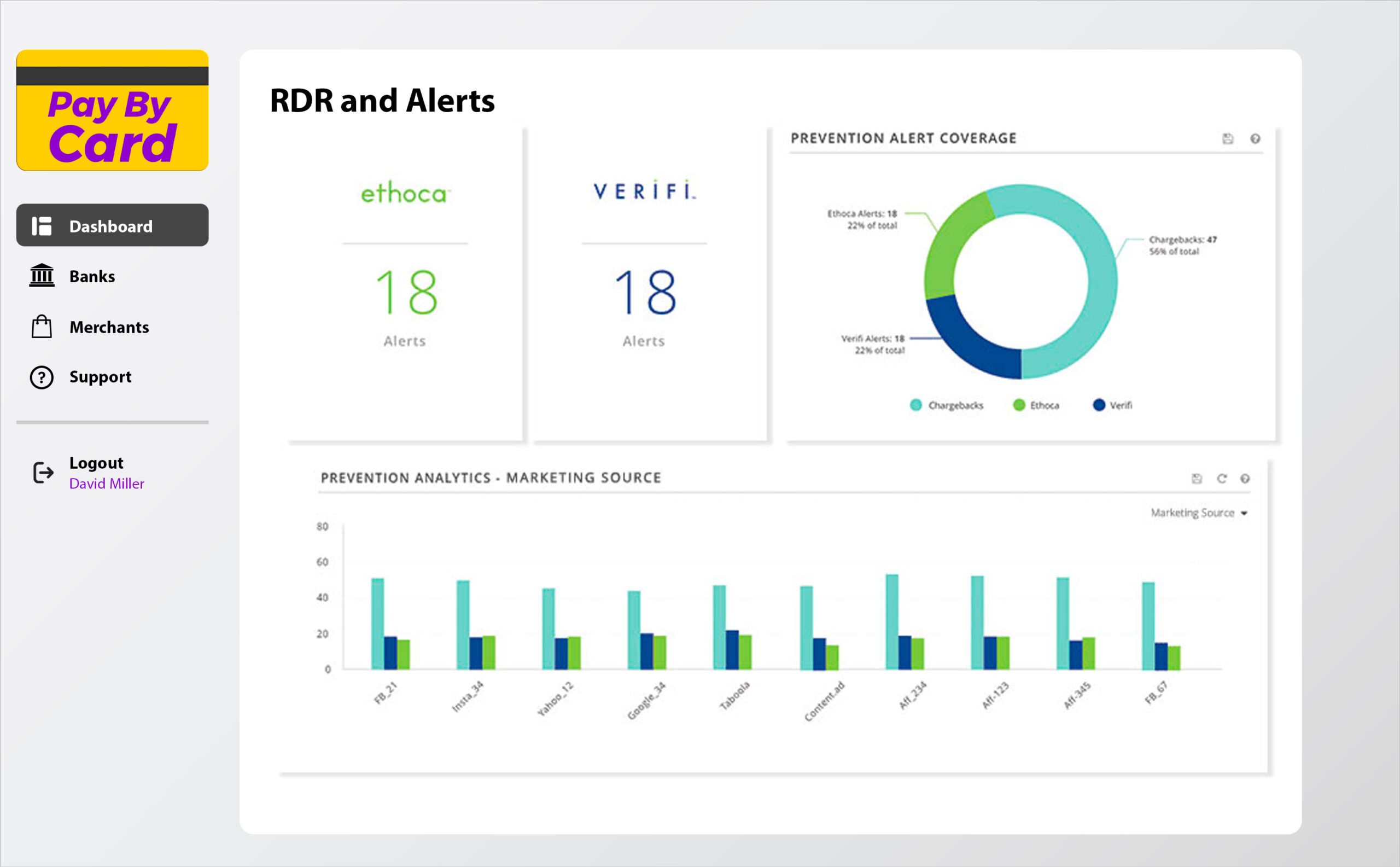

What is Rapid Dispute Resolution by Verifi and Alerts by Ethoca?Rapid Dispute Resolution (RDR) and Alerts are tools that allows merchants to respond to disputes with automatic refunds instead of going through a complex chargeback process and losing money. RDR and Alerts provide real-time resolution for disputes. We offer our solution in partnership with Verifi (Visa) and Ethoca (Mastercard).How it works?1. A transaction is disputedThe cardholder contacts the bank to dispute a transaction that he does not recognize.2. RDR is initiatedThe cardholder’s bank activates the RDR system.3. Filters chosen by the merchant are appliedOur tool consults your pre-set filters and RDR Rules to determine whether or not the transaction should be refunded.4. Refund is issuedIf the transaction meets the pre-set filters, the qualifying transaction is automatically refunded on your behalf.5. Chargeback is avoidedChargeback is prevented, and your funds are safe. |

Our Vision

We aim to revolutionize how businesses manage their financial transactions, offering secure and innovative merchant processing solutions that enhance efficiency and drive growth. Our commitment to excellence ensures that every client receives personalized service and support tailored to their unique needs.

With Pay By Card, businesses can trust in our expertise to navigate the complexities of payment processing, enabling them to focus on what matters most—growing their business. We strive to be the trusted partner that businesses rely on for secure, reliable, and forward-thinking payment solutions.

Join us as we continue to innovate and set new standards in merchant processing, empowering businesses to thrive in a rapidly evolving digital economy.

TESTIMONIALS

Anna Patel

TechPros Solutions

Carlos Ramirez

Rami Auto Parts

Sophie Nguyen

Nguyen's Fashion Boutique

Omar Khan

Breor Advertising

Leila Garcia

Huna Gourmet Foods

FAQ’s